READ TIME: 3 MIN

While many understand the benefits of traditional 401(k) plans, Roth 401(k)s may be less familiar to some.

Employers have had the option to offer Roth 401(k) plans since January 1, 2006. In 2023, updated retirement rules expanded the availability of Roth contributions in more retirement plans.

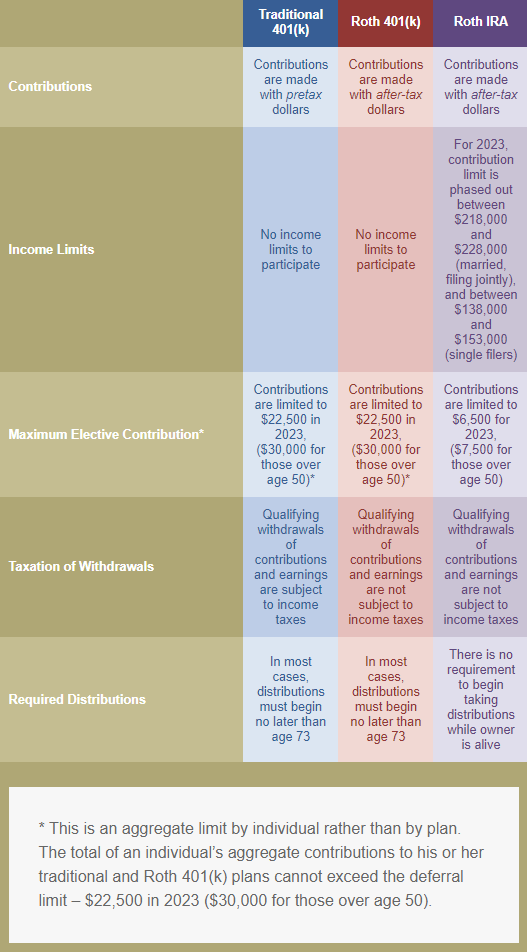

These plans blend features from traditional 401(k) plans and Roth IRAs. In a Roth 401(k), you make contributions with after-tax dollars. Although there’s no upfront tax deduction, qualifying withdrawals, including any capital appreciation, are tax-free.

What to Choose?

Deciding between a Roth 401(k) and a traditional 401(k) often hinges on comparing the immediate tax break of a traditional 401(k) with the tax-free withdrawals of a Roth 401(k).

Remember, this article is for informational purposes only. Consult a tax professional before modifying your retirement strategy.

The decision doesn’t have to be all-or-nothing. Many employers permit splitting contributions between traditional and Roth 401(k) plans, respecting overall contribution limits.

Considerations

A crucial point about Roth 401(k) plans is their lack of income restrictions, unlike Roth IRAs. This is particularly beneficial for high-income earners limited by IRA restrictions.

The annual contribution limits for Roth 401(k) plans in 2023 are $22,500, or $30,000 for those over 50. These limits are cumulative across all accounts with one employer; for instance, you can’t contribute $22,500 each to a traditional and a Roth 401(k).

Another factor is that employer matches in these plans are made with pretax dollars. These matching funds go into a separate account and are taxed as ordinary income upon withdrawal.

Incorporating a traditional or Roth 401(k) into your retirement planning involves assessing various factors. If unsure about the best choice for your situation, consider consulting a qualified tax or financial professional.

Share

1. To qualify for the tax-free and penalty-free withdrawal of earnings, Roth 401(k) distributions must meet a five-year holding requirement and occur after age 59½. Tax-free and penalty-free withdrawals also can be taken under certain other circumstances, such as a result of the owner’s death or disability. Employer matches are pretax and not distributed tax-free during retirement. Once you reach age 73, you must begin taking required minimum distributions.

2. Forbes.com, January 5, 2023

3. In most circumstances, you must begin taking required minimum distributions from your 401(k) or other defined contribution plan in the year you turn 73. Withdrawals from your 401(k) or other defined contribution plans are taxed as ordinary income, and, if taken before age 59½, may be subject to a 10% federal income tax penalty.

4. Roth IRA contributions cannot be made by taxpayers with high incomes. In 2023, the income phaseout limit is $153,000 for single filers, $228,000 for married filing jointly. To qualify for the tax-free and penalty-free withdrawal of earnings, Roth IRA distributions must meet a five-year holding requirement and occur after age 59½. Tax-free and penalty-free withdrawals also can be taken under certain other circumstances, such as a result of the owner’s death or disability. The original Roth IRA owner is not required to take minimum annual withdrawals.

5. IRS.gov 2023