In the evolving landscape of retirement planning, the SECURE Act 2.0 stands as a pivotal piece of legislation designed to enhance the financial security of Americans. Firstly, this act, an extension of the original Setting Every Community Up for Retirement Enhancement (SECURE) Act, brings forth significant reforms aimed at bolstering retirement savings and planning. Moreover, let’s delve into the critical aspects of the SECURE Act 2.0, understanding its implications and how it aims to reshape retirement planning.

Understanding SECURE Act 2.0

At its core, the SECURE Act 2.0 is legislation intended to provide Americans with improved pathways to securing a financially stable retirement. Specifically, SECURE, an acronym for Setting Every Community Up for Retirement Enhancement, underscores the act’s broad objective of elevating the retirement readiness of individuals across various demographics.

Why the SECURE Act 2.0 Was Enacted

Legislators put the SECURE Act 2.0 into place to address several challenges facing retirement savings in the United States. The aging population and changing economic dynamics created a pressing need. It was essential to update and expand the provisions of the original SECURE Act, making retirement planning more accessible and flexible for more Americans.

Key Changes to Watch

Several key changes introduced by the SECURE Act 2.0 are pivotal for individuals planning for retirement.

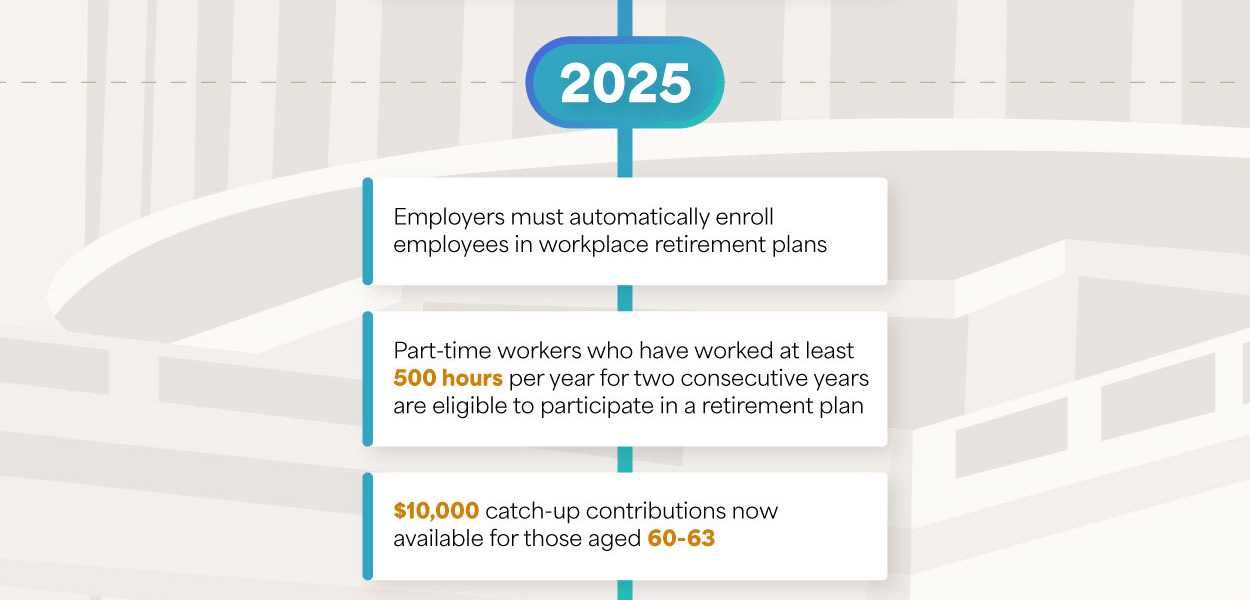

First, the expansion of automatic enrollment in retirement plans. Employers are now encouraged to automatically enroll employees in retirement plans, with the option for employees to opt-out, thereby increasing participation rates.

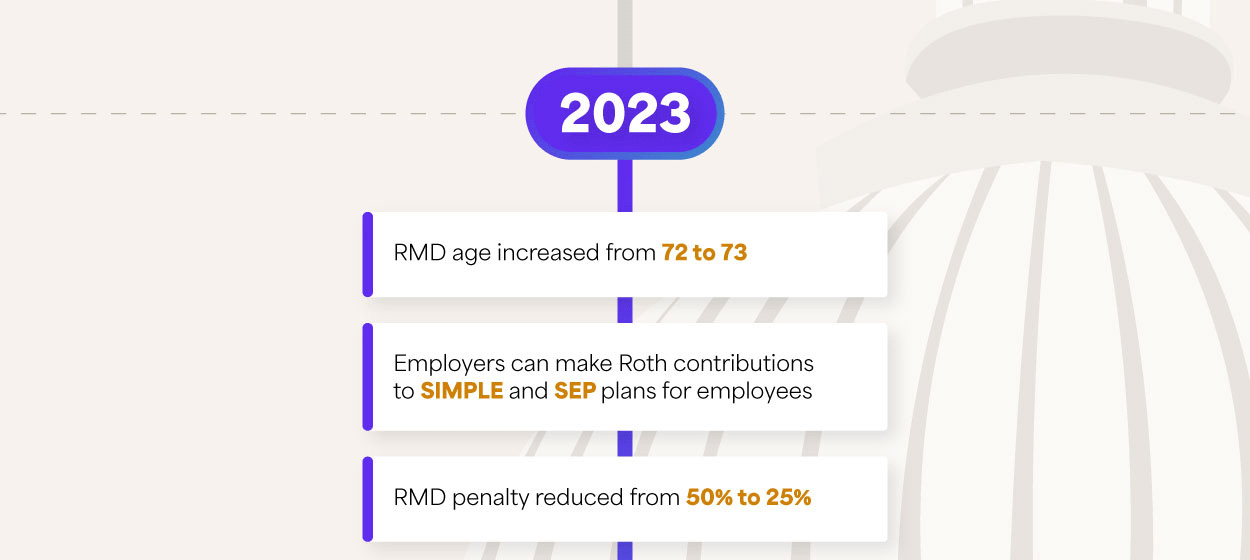

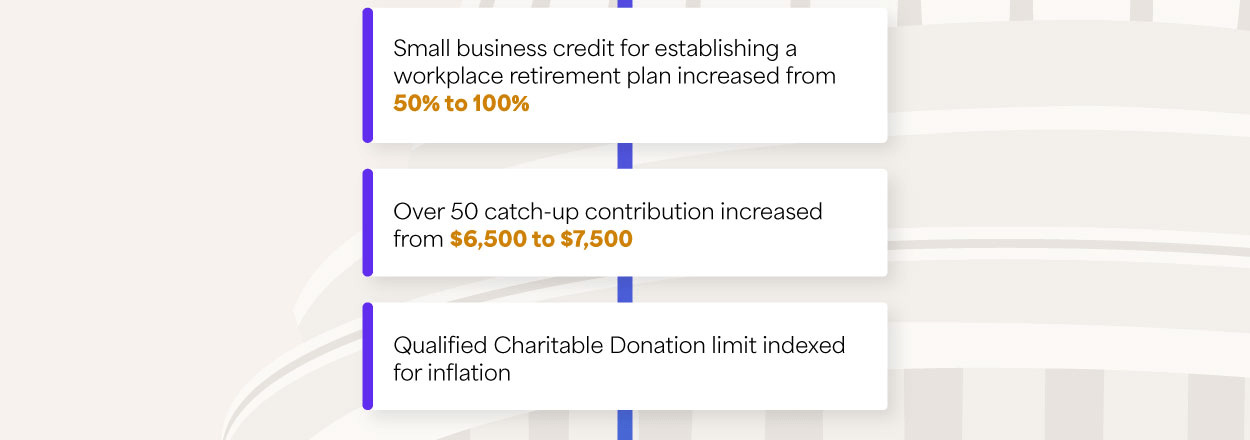

Second, increased catch-up contributions. For individuals aged 50 and above, the act allows for higher catch-up contributions to 401(k) and other employer-sponsored retirement plans.

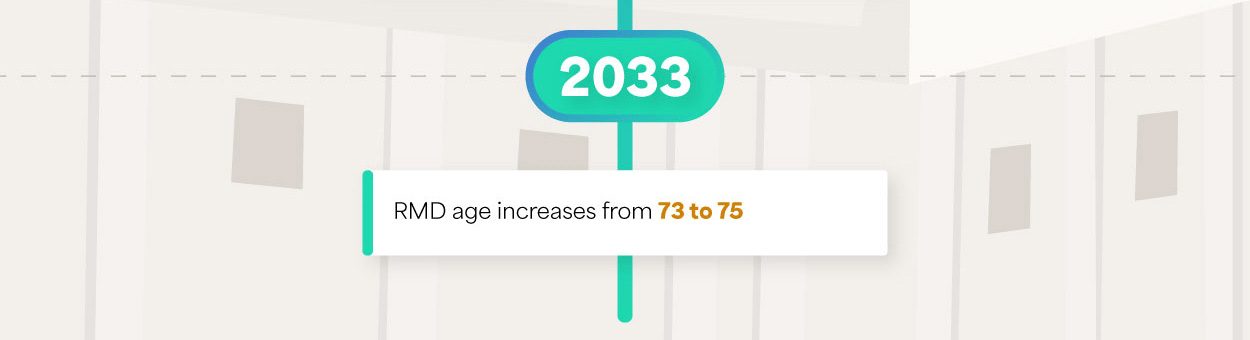

Third, the delay in Required Minimum Distributions (RMDs). The age for required minimum distributions from retirement accounts has been pushed back, allowing for longer growth periods of retirement savings.

Finally, penalty-free withdrawals under certain conditions. The act introduces provisions for penalty-free withdrawals from retirement accounts for specific life events, such as the birth of a child or a serious illness. Consult with a professional before making a decision like this.

Benefits for Individuals

The SECURE Act 2.0 offers numerous benefits for individuals, aimed at enhancing their ability to save effectively for retirement. The act increases the flexibility and accessibility of retirement savings options. This helps individuals to better prepare for their retirement years, potentially leading to a more financially secure and comfortable retirement.

Potential Challenges

However, while the SECURE Act 2.0 brings significant advantages, it may also present challenges for some individuals. Navigating the new rules and understanding the best strategies for taking advantage of the changes will require careful planning and possibly advice from financial planning professionals.

Conclusion

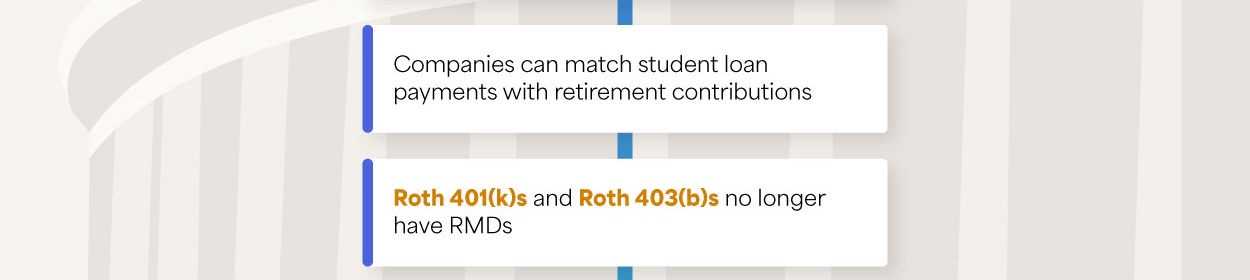

The SECURE Act 2.0 represents a significant step forward in retirement planning legislation, offering new opportunities and benefits for individuals looking to secure their financial future. As we adapt to these changes, staying informed and seeking professional guidance when necessary will be key to maximizing the benefits of the act and overcoming any challenges it may present. Explore our infographic below to grasp the pivotal changes initiated in 2023, complemented by an overview of anticipated updates on the horizon.