Chris Rock once remarked, “You don’t pay taxes – they take taxes.” That applies not only to income but also to capital gains.

Firstly, capital gains result when an individual sells an investment for an amount greater than their purchase price. Specifically, investors categorize capital gains as short-term gains (realizing a gain on an asset held one year or less) or long-term gains (realizing a gain on an asset held longer than one year).

Moreover, it’s important to keep in mind that the information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation.

Long-Term vs. Short-Term Gains

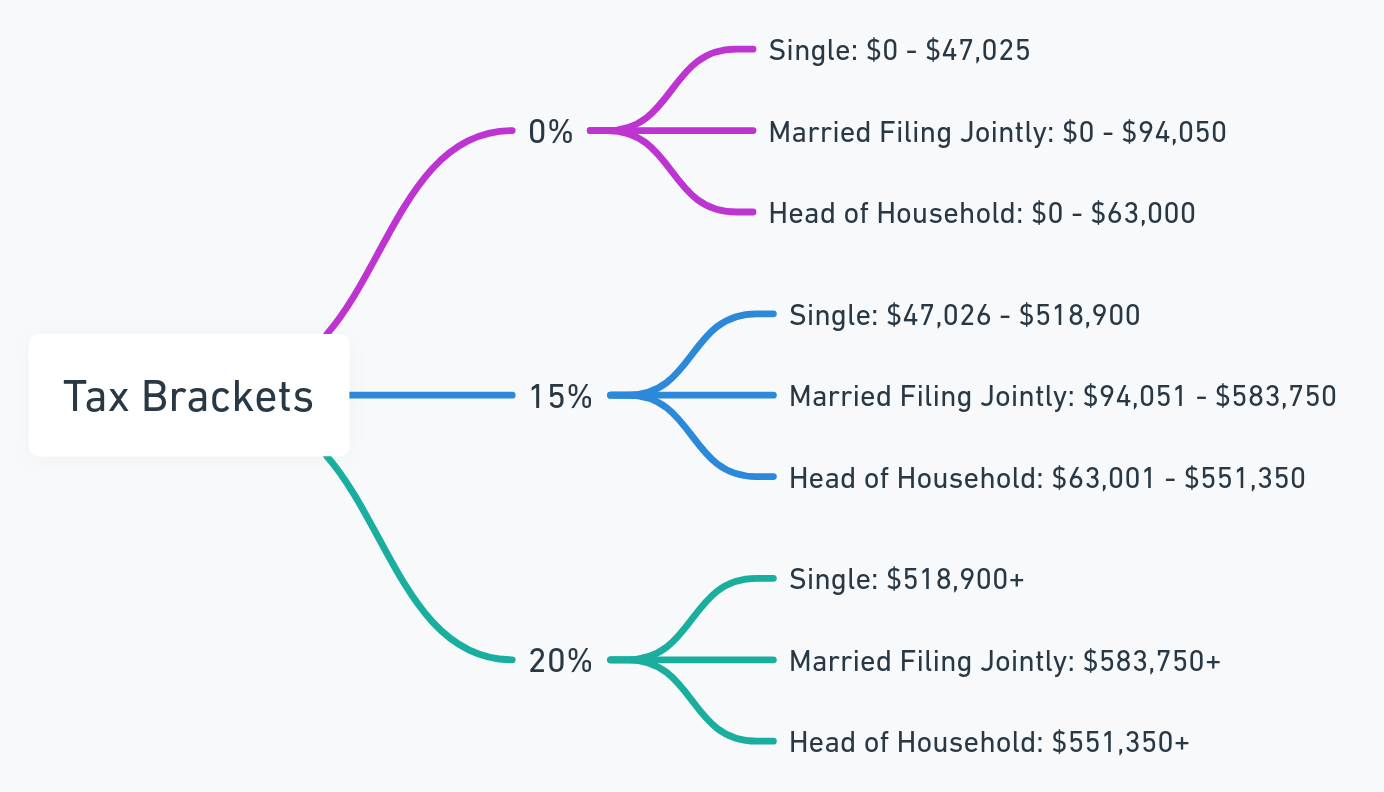

Short-term capital gains are taxed at ordinary income tax rates. Long-term gains are taxed according to different ranges (shown below).1

Long Term Capital Gains Tax Brackets (for 2024)

Taxpayers with an adjusted gross income exceeding $200,000 (for single filers or heads of household) or $250,000 (for joint filers) may face an additional 3.8% net investment income tax.2

Also, keep in mind that the long-term capital gains rate for collectibles and precious metals remains at a maximum of 28%.3

Rules for Capital Losses

When it comes to the rules for capital losses, investors can use those losses to offset capital gains. If the losses exceed the gains, up to $3,000 of those losses may be used to offset the taxes on other kinds of income. Should you have more than $3,000 in such capital losses, you may be able to carry the losses forward. You can continue to carry forward these losses until such time that future realized gains exhaust them. Under current law, the ability to carry these losses forward is lost only on death.4

Finally, for some assets, the calculation of a capital gain or loss may not be as simple and straightforward as it sounds. As with any matter dealing with taxes, individuals are encouraged to seek the counsel of a tax professional before making any tax-related decisions.

1. IRS.gov, 2024

2. IRS.gov, 2024

3. Investopedia.com, November 28, 2023

4. IRS.gov, 2024